Preparing for the Big January Report

Dec 02, 2022

Zack Gardner

Grain Marketing & Origination Specialist

This is a weird analogy, but oddly the best one I know of for describing risk protection for grain prices. A minimum price contract is your seat cushion on an airplane. You hope the plane doesn’t crash, but in the unlikely event of an emergency water landing, you may use your seat cushion as a flotation device. If the plane (grain markets) happens to go lower on the January report, your seat cushion (minimum price contract) prevents your price from going lower.

I haven’t preached options for quite some time as they have been ridiculously expensive. They have essentially doubled in price over the past two years as the underlying commodities have rallied. But since we’ve been stuck in a ~$.30 trading range for the past two months, options pricing has actually cheapened a bit as a lot of the volatility and time premium has been taken out of the market.

I’m not saying the January report is going to be bearish, but there is a good chance that it could be.

Examples:

Grain Marketing & Origination Specialist

This is a weird analogy, but oddly the best one I know of for describing risk protection for grain prices. A minimum price contract is your seat cushion on an airplane. You hope the plane doesn’t crash, but in the unlikely event of an emergency water landing, you may use your seat cushion as a flotation device. If the plane (grain markets) happens to go lower on the January report, your seat cushion (minimum price contract) prevents your price from going lower.

I haven’t preached options for quite some time as they have been ridiculously expensive. They have essentially doubled in price over the past two years as the underlying commodities have rallied. But since we’ve been stuck in a ~$.30 trading range for the past two months, options pricing has actually cheapened a bit as a lot of the volatility and time premium has been taken out of the market.

I’m not saying the January report is going to be bearish, but there is a good chance that it could be.

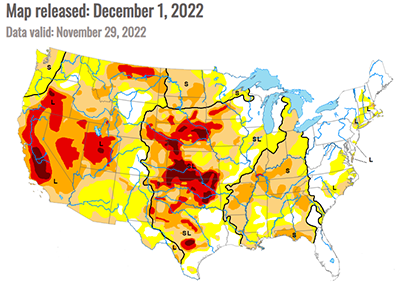

- Yield: There were a couple pockets throughout the country where yield was as bad as expected, but overall yield turned out surprisingly better than anticipated back in August. It’s definitely not last year’s crop, but at least it’s better than the train wreck we had been expecting. My one argument for the USDA not raising yield would be what the basis is telling us.

- Exports: I don’t think we’ve hit our “weekly needed” sales amount on corn even once this crop year!

- Ethanol: Production is good on weeks when basis is cheap, but ethanol plants here in Iowa tend to slow when they need to pay quick ship bid prices. Taking this a step further - if they tend to slow when paying above +25 here in Iowa, what do we think will happen to ethanol plants in Nebraska and Kansas where the local basis is +150 or higher?

Examples:

- Eddyville has been throwing out some $7.00 quick ship bids here and there. When we do a minimum price contract, we sell cash at $7.00 and we could buy a March ’23 $6.60 (at-the-money) call option for $.23. Seeing we sold cash, we can’t go any lower than losing the full value of our call option, so our price floor is $6.77 cash ($7.00 cash - $.23 call option). With a March option, we retain our upside potential through February 24th, which gets us past the January report and part way into the spring crop insurance pricing period.

- ADM Des Moines has hit $15.00 cash a couple times. For a bean call option example we could sell $15.00 cash and buy a March ’23 $14.30 call option for $.50. This would give us a floor of $14.50 cash while still retaining our upside in case we see $17.00 beans again this year. I’m a little less worried about soybeans on the January report as we’ve had solid exports and a solid crush market so far this year, but I like the idea of bean options as well with Brazil potentially producing a record soybean crop that gets harvested in February.