Don't Forget About Forward Marketing New Crop

Feb 01, 2023

Zack Gardner

Grain Marketing & Origination Specialist

Forward Marketing

I can’t remember the exact saying, but prior to the derecho I remember hearing that 8 out of 10 years is typically an oversupplied market that pays to forward market. The other 2 years are typically a bull market that pays to sit on your hands and play keep away with the end users. Then, the next 3 years are spent trying to remind ourselves that it pays to forward market 80% of the time.

I’m not saying that the markets are taking the express elevator down. The markets do need to keep a significant amount of risk premium in them as we haven’t fully recovered on moisture yet and there is still a war going on in the Black Sea, but we can’t forget about forward marketing. It has been hard forward marketing the past 2 years and then watching the markets go higher than our sales later in the season, but 80% odds are pretty darn good in my book. At least they’re better than my odds in Vegas on a roulette wheel (50/50 chance of red or black and I somehow land on a green space!). So the question here really is, do we see the traditional downward slide in year three of the bull market? Or do we break the typical cycle and see a third year of bull markets?

The Big January USDA Report

On January 12th, the USDA surprised the market with a friendly/bullish report, but new crop futures didn’t go up. I can justify old crop futures going higher as the USDA gave us a tighter grain supply, but I think the higher prices only exacerbate demand destruction and more acres getting planted for next year. The higher our prices go, the more expensive our bushels are to other countries for export, the more expensive they are to crush for ethanol, and the more expensive they are to feed. Also, the higher commodity prices go, the more incentive there is for Brazilian farmers to convert some 400 million hectares (988 million acres) of available pasture over to row crops. Now, before you go thinking that I’m all sorts of crazy for putting a bearish sentiment on a bullish report, the markets so far are supporting this as well. In the 7 trading days after the report, new crop corn is only $.02 higher and new crop beans are down $.49.

Weather

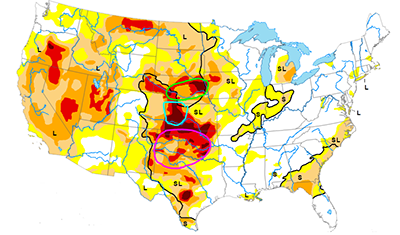

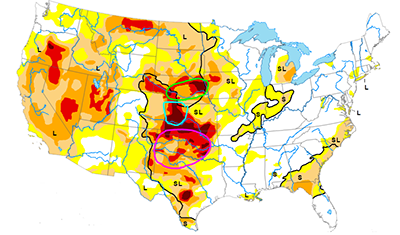

The global weather pattern appears to be changing. I am usually the last one to jump onto the South American drought bandwagon, but I will also be the last one to jump off. One or two rains won’t fix a drought, and if it did, it wasn’t a drought to begin with. But when the drought areas of both Argentina and the US West Coast (California) get significant moisture, and then the U.S. Plains see snow the following week, it really starts to make you wonder. The weather stations have also started talking about the La Nina weather pattern switching to an El Nino pattern (I’ll won’t hold my breath and will wait for the rain to fall). Below is the current drought monitor:

Remember This..

In summary, please don’t forget about marketing new crop. Don’t let these end users fighting over old crop bushels keep you from looking at new crop. New crop can go down while old crop goes up. I think I’ve said this in my past three newsletters, but my biggest fear is producers buying high priced inputs and not locking in enough grain to cover it - so please don’t forget about marketing new crop. There are several different contract types for forward marketing next year’s bushels. There is even a contract to lock in a floor while retaining your upside potential in case we see a third year of bull markets.

Just in case I didn’t get my point across about the risk of not paying attention to new crop, here’s a chart of new crop corn from 2013, showing our drop from the $5.90’s in January (eerily similar to where we are today) down to ~$4.50 in harvest.

Grain Marketing & Origination Specialist

Forward Marketing

I can’t remember the exact saying, but prior to the derecho I remember hearing that 8 out of 10 years is typically an oversupplied market that pays to forward market. The other 2 years are typically a bull market that pays to sit on your hands and play keep away with the end users. Then, the next 3 years are spent trying to remind ourselves that it pays to forward market 80% of the time.

I’m not saying that the markets are taking the express elevator down. The markets do need to keep a significant amount of risk premium in them as we haven’t fully recovered on moisture yet and there is still a war going on in the Black Sea, but we can’t forget about forward marketing. It has been hard forward marketing the past 2 years and then watching the markets go higher than our sales later in the season, but 80% odds are pretty darn good in my book. At least they’re better than my odds in Vegas on a roulette wheel (50/50 chance of red or black and I somehow land on a green space!). So the question here really is, do we see the traditional downward slide in year three of the bull market? Or do we break the typical cycle and see a third year of bull markets?

The Big January USDA Report

On January 12th, the USDA surprised the market with a friendly/bullish report, but new crop futures didn’t go up. I can justify old crop futures going higher as the USDA gave us a tighter grain supply, but I think the higher prices only exacerbate demand destruction and more acres getting planted for next year. The higher our prices go, the more expensive our bushels are to other countries for export, the more expensive they are to crush for ethanol, and the more expensive they are to feed. Also, the higher commodity prices go, the more incentive there is for Brazilian farmers to convert some 400 million hectares (988 million acres) of available pasture over to row crops. Now, before you go thinking that I’m all sorts of crazy for putting a bearish sentiment on a bullish report, the markets so far are supporting this as well. In the 7 trading days after the report, new crop corn is only $.02 higher and new crop beans are down $.49.

Weather

The global weather pattern appears to be changing. I am usually the last one to jump onto the South American drought bandwagon, but I will also be the last one to jump off. One or two rains won’t fix a drought, and if it did, it wasn’t a drought to begin with. But when the drought areas of both Argentina and the US West Coast (California) get significant moisture, and then the U.S. Plains see snow the following week, it really starts to make you wonder. The weather stations have also started talking about the La Nina weather pattern switching to an El Nino pattern (I’ll won’t hold my breath and will wait for the rain to fall). Below is the current drought monitor:

- The first thing I notice is just how much of the drought areas in the eastern corn belt have been reduced down to “abnormally dry” in yellow.

- Circled in green is roughly the area of Nebraska that got a foot of snow around the third week of January.

- A couple days later, the blue circle in western Kansas got 6-12” of snow.

- A couple days after that, the Texas panhandle and Oklahoma got a solid dusting of snow (1-4”).

Remember This..

In summary, please don’t forget about marketing new crop. Don’t let these end users fighting over old crop bushels keep you from looking at new crop. New crop can go down while old crop goes up. I think I’ve said this in my past three newsletters, but my biggest fear is producers buying high priced inputs and not locking in enough grain to cover it - so please don’t forget about marketing new crop. There are several different contract types for forward marketing next year’s bushels. There is even a contract to lock in a floor while retaining your upside potential in case we see a third year of bull markets.

Just in case I didn’t get my point across about the risk of not paying attention to new crop, here’s a chart of new crop corn from 2013, showing our drop from the $5.90’s in January (eerily similar to where we are today) down to ~$4.50 in harvest.