Don't Let Grain Marketing Take a Back Seat

May 03, 2024

Zack Gardner

Grain Marketing and Origination Specialist

THERE HAVE BEEN MANY YEARS where the market has made a significant move at the same time producers were busy getting the crop planted. It’s easy to allow grain marketing to take a back seat while you’re in the tractor seat—hauling grain is not a high priority during spring. Nevertheless, it is a great time to have an offer working to sell your grain.

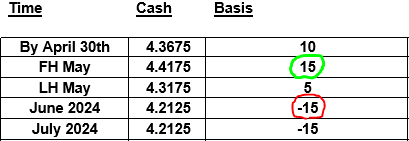

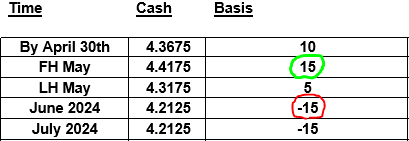

As field work progresses, grain that’s sitting in storage at an elevator can be sold without any effort. I would encourage producers to take the time to determine some target prices for stored bushels. With futures moves and basis changes, you never know when that target price may be met. Here are a couple of reminders:

Lower prices have a lot of producers holding on to grain for longer than they typically do. If this trend continues, it may turn into six months’ worth of corn hitting the market in the last three months before harvest. I think a lot of these end users are thinking the same way, which is why they are bidding approximately $0.30/bushel better for the April/May timeframe. Does this suggest being a little more proactive than your neighbor?

Don’t forget to keep an eye on the markets this spring while you’re busy in the tractor!

Grain Marketing and Origination Specialist

THERE HAVE BEEN MANY YEARS where the market has made a significant move at the same time producers were busy getting the crop planted. It’s easy to allow grain marketing to take a back seat while you’re in the tractor seat—hauling grain is not a high priority during spring. Nevertheless, it is a great time to have an offer working to sell your grain.

As field work progresses, grain that’s sitting in storage at an elevator can be sold without any effort. I would encourage producers to take the time to determine some target prices for stored bushels. With futures moves and basis changes, you never know when that target price may be met. Here are a couple of reminders:

- Cash offers are always working, whether it’s during business hours or while the CME is trading at night.

- Cash offers are only good until the month is over (i.e., if you have a cash offer in place for May delivery, that offer would expire on May 31). The offer would need to be reentered for the next month in order for it to continue.

Lower prices have a lot of producers holding on to grain for longer than they typically do. If this trend continues, it may turn into six months’ worth of corn hitting the market in the last three months before harvest. I think a lot of these end users are thinking the same way, which is why they are bidding approximately $0.30/bushel better for the April/May timeframe. Does this suggest being a little more proactive than your neighbor?

Don’t forget to keep an eye on the markets this spring while you’re busy in the tractor!