Fat Bear Week Came to a Close, In More Way Than One

Oct 04, 2021

Zack Gardner

Grain Marketing & Origination Specialist

Last week’s grain markets seemed particularly bearish. For how bullish the markets have been all year long, there sure seemed to be a lot of bearish news last week. Yes, Fat Bear Week came to a close. But I’m not just talking about Katmai National Park’s brown bear bulking competition to see which bear could “prepare” the best for winter hibernation. (Google it…this really is a thing!) The headlines last week were just filled with bearish news. Below are some examples:

The Gulf Export Market- Hurricane Ida made landfall in Louisiana on August 29th. As of last week, we only loaded out/exported about 40 percent of what we needed to for the week in order to stay on pace with the USDA’s export estimate for the year. At least we are seeing incremental improvement week over week, but we’re still not back up to full loading capacity out of our Gulf market…and it’s been five whole weeks.

Export Basis- The next bearish piece of the puzzle is our export basis levels. At first glance, the export market looks fairly friendly, since we’re currently the cheapest source of soybeans in the world. (Currently $.44/bu cheaper than Paranagua, Brazil) What I see when I look further out, is how cheap Paranagua, Brazil is after January. If China needs beans today, they’re going to buy them from us. But, if they don’t need beans today, they could wait until February and buy them for $1.00/bu cheaper down in Brazil.

Energy Crisis- Two weeks ago, China ordered 20+ soy processing plants to shut down, along with many other industrial plants, due to skyrocketing energy costs. Since then (~2 weeks later), China’s Vice Premier Han Zheng ordered the country’s top state-owned energy companies to secure supplies at all costs. Since that announcement, some of these soy processing plants have re-opened, while some still remain closed. This is bearish as it cut the immediate demand for soybeans off since these plants were shut down. Longer term, it begs the questions: Doesn’t China’s hog herd need the bean meal for feed? Does that imply that their hog herd isn’t built back up? Are they intentionally slowing down their bean grind to get by until they can get Brazil’s dollar-cheaper soybeans this winter?

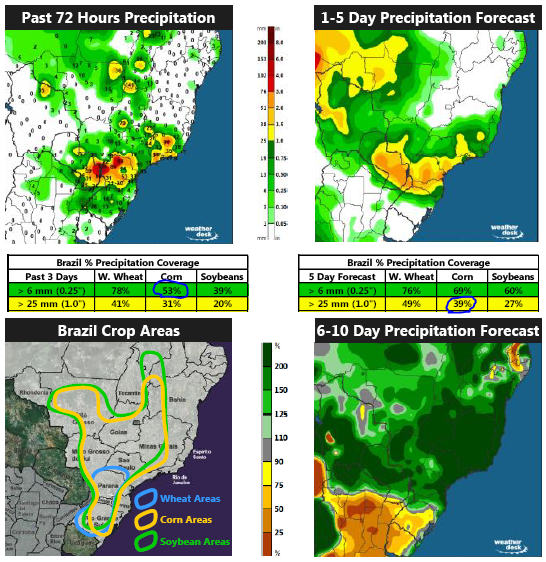

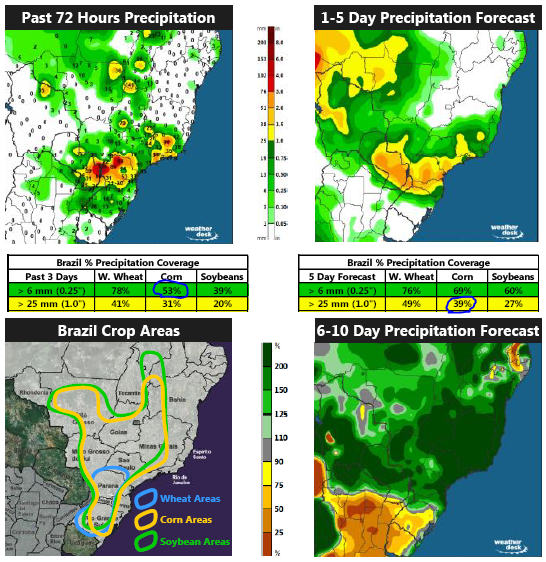

Brazil’s Planting Weather- Brazil is off to a great start with good moisture levels. Between current futures prices and their currency devaluing, the market is incentivizing them to plant corn like crazy. They’re currently 35.7 percent planted on their first corn crop, which is 10.5 percent ahead of last year at this time. As you can see on the chart below, half of the Brazil corn crop just received a quarter inch of rain and in the five day forecast, 39 percent of Brazil’s corn acres should receive an inch or more of rain.

USDA Report- Last Thursday, the USDA released their fourth quarter ending stocks report. It was the final straw to add to the bearishness of last week. Long story short, the report said that we finished the year with higher than expected stocks. This shouldn’t have been a shock to the market as we knew we fell down on some exports. We knew we fed a lot of wheat over the summer and corn got expensive before wheat started to rally. However, the market still went south since the report added ~80 million bushels of both corn and soybeans back into our supply. The report just confirmed that we never really ran out of grain this past year. Yes basis got high, but no matter how high it got, it always found more bushels.

Now, before we get too bearish, let’s remind ourselves that we have $5.00 corn and $12.00 bean futures for a reason. There’s still a lot of risk premium in this market. At the end of the day, we’re still the cheapest source of soybeans in the world today. Anyone who needs soybeans is going to buy from us. As far as corn goes, (in theory) corn needs to stay supported otherwise we switch way too many corn acres over to soybeans just to avoid high fertilizer prices this next year. At this moment in time, Dec ’22 futures is hitting new contract highs. Lastly, inflation is still real! Energy prices are skyrocketing, supply chains are still disrupted and the world still can’t find enough workers. The world needs the food you grow - and commodities like corn, soybeans and wheat are great inflation hedges.

Grain Marketing & Origination Specialist

Last week’s grain markets seemed particularly bearish. For how bullish the markets have been all year long, there sure seemed to be a lot of bearish news last week. Yes, Fat Bear Week came to a close. But I’m not just talking about Katmai National Park’s brown bear bulking competition to see which bear could “prepare” the best for winter hibernation. (Google it…this really is a thing!) The headlines last week were just filled with bearish news. Below are some examples:

The Gulf Export Market- Hurricane Ida made landfall in Louisiana on August 29th. As of last week, we only loaded out/exported about 40 percent of what we needed to for the week in order to stay on pace with the USDA’s export estimate for the year. At least we are seeing incremental improvement week over week, but we’re still not back up to full loading capacity out of our Gulf market…and it’s been five whole weeks.

Export Basis- The next bearish piece of the puzzle is our export basis levels. At first glance, the export market looks fairly friendly, since we’re currently the cheapest source of soybeans in the world. (Currently $.44/bu cheaper than Paranagua, Brazil) What I see when I look further out, is how cheap Paranagua, Brazil is after January. If China needs beans today, they’re going to buy them from us. But, if they don’t need beans today, they could wait until February and buy them for $1.00/bu cheaper down in Brazil.

Energy Crisis- Two weeks ago, China ordered 20+ soy processing plants to shut down, along with many other industrial plants, due to skyrocketing energy costs. Since then (~2 weeks later), China’s Vice Premier Han Zheng ordered the country’s top state-owned energy companies to secure supplies at all costs. Since that announcement, some of these soy processing plants have re-opened, while some still remain closed. This is bearish as it cut the immediate demand for soybeans off since these plants were shut down. Longer term, it begs the questions: Doesn’t China’s hog herd need the bean meal for feed? Does that imply that their hog herd isn’t built back up? Are they intentionally slowing down their bean grind to get by until they can get Brazil’s dollar-cheaper soybeans this winter?

Brazil’s Planting Weather- Brazil is off to a great start with good moisture levels. Between current futures prices and their currency devaluing, the market is incentivizing them to plant corn like crazy. They’re currently 35.7 percent planted on their first corn crop, which is 10.5 percent ahead of last year at this time. As you can see on the chart below, half of the Brazil corn crop just received a quarter inch of rain and in the five day forecast, 39 percent of Brazil’s corn acres should receive an inch or more of rain.

USDA Report- Last Thursday, the USDA released their fourth quarter ending stocks report. It was the final straw to add to the bearishness of last week. Long story short, the report said that we finished the year with higher than expected stocks. This shouldn’t have been a shock to the market as we knew we fell down on some exports. We knew we fed a lot of wheat over the summer and corn got expensive before wheat started to rally. However, the market still went south since the report added ~80 million bushels of both corn and soybeans back into our supply. The report just confirmed that we never really ran out of grain this past year. Yes basis got high, but no matter how high it got, it always found more bushels.

Now, before we get too bearish, let’s remind ourselves that we have $5.00 corn and $12.00 bean futures for a reason. There’s still a lot of risk premium in this market. At the end of the day, we’re still the cheapest source of soybeans in the world today. Anyone who needs soybeans is going to buy from us. As far as corn goes, (in theory) corn needs to stay supported otherwise we switch way too many corn acres over to soybeans just to avoid high fertilizer prices this next year. At this moment in time, Dec ’22 futures is hitting new contract highs. Lastly, inflation is still real! Energy prices are skyrocketing, supply chains are still disrupted and the world still can’t find enough workers. The world needs the food you grow - and commodities like corn, soybeans and wheat are great inflation hedges.