Having a Plan for This Year and Next Year’s Crops

Jan 03, 2024

Jarod Lemper

Grain Division Manager

HOW QUICKLY THE CALENDAR FLIPS and a new year begins! In the grain marketing world, it isn’t such a clean break. Harvest is fresh in our minds, with the bins still full. But next year’s crop is already on the minds of many. Having a plan in place for both crops is important.

Currently, farmers own 16.5 million bushels of old crop grain in the elevator. This is up 96 percent from the previous three-year average. That tells me there are a lot of producers out there waiting for higher prices. The question then becomes: Will those higher prices develop?

If we look back to a year ago, the projected carryout for the 2022–2023 crop was 220 million bushels for soybeans and 1.26 billion bushels for corn. Looking at the latest report for the 2023–2024 crop year, projected carryout figures are 245 million bushels for soybeans and 2.13 billion bushels for corn. That is a growth of 25 million bushels for soybeans and about 875 million bushels for corn. Rising carryout numbers are not usually conducive to higher prices.

May 2024 futures have not been above $5.30 since late July 2023. But there have been a couple of runs at the $5.20s, one as recent as late October. Based on the charts below, targeting anything in the $5.10–$5.25 futures area would be a good place to market additional old crop bushels.

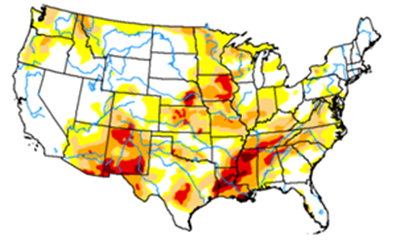

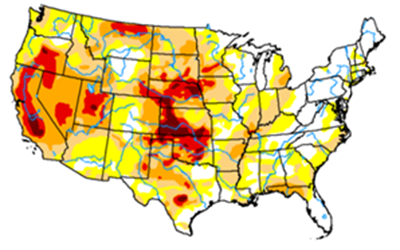

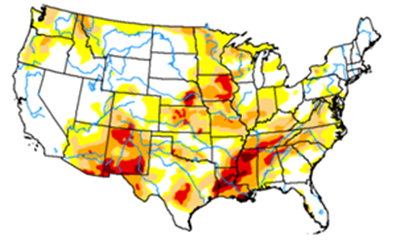

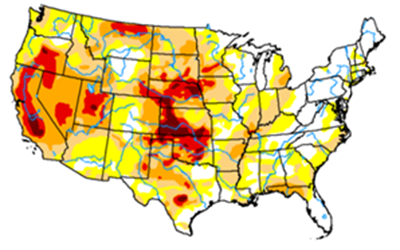

Looking ahead, one of the greatest reservations of forward marketing is that we are going on year four of a drought, and we need to recuperate a tremendous amount of moisture before we can grow a crop. That being said, the Funds traders currently have another successful crop priced in for next year. We have grown three crops in a row in drought conditions, so they’re not willing to bet against us producing a fourth (especially with nine percent interest costs on margining a long/bullish position on the board). However, just because a successful crop is already priced doesn’t mean we won’t see a weather scare rally. It just tells me that if or when we see one, it will occur more quickly and more drastically. Be sure to have a plan in mind and offers in for when we start seeing the markets move!

Grain Division Manager

HOW QUICKLY THE CALENDAR FLIPS and a new year begins! In the grain marketing world, it isn’t such a clean break. Harvest is fresh in our minds, with the bins still full. But next year’s crop is already on the minds of many. Having a plan in place for both crops is important.

Currently, farmers own 16.5 million bushels of old crop grain in the elevator. This is up 96 percent from the previous three-year average. That tells me there are a lot of producers out there waiting for higher prices. The question then becomes: Will those higher prices develop?

If we look back to a year ago, the projected carryout for the 2022–2023 crop was 220 million bushels for soybeans and 1.26 billion bushels for corn. Looking at the latest report for the 2023–2024 crop year, projected carryout figures are 245 million bushels for soybeans and 2.13 billion bushels for corn. That is a growth of 25 million bushels for soybeans and about 875 million bushels for corn. Rising carryout numbers are not usually conducive to higher prices.

May 2024 futures have not been above $5.30 since late July 2023. But there have been a couple of runs at the $5.20s, one as recent as late October. Based on the charts below, targeting anything in the $5.10–$5.25 futures area would be a good place to market additional old crop bushels.

Looking ahead, one of the greatest reservations of forward marketing is that we are going on year four of a drought, and we need to recuperate a tremendous amount of moisture before we can grow a crop. That being said, the Funds traders currently have another successful crop priced in for next year. We have grown three crops in a row in drought conditions, so they’re not willing to bet against us producing a fourth (especially with nine percent interest costs on margining a long/bullish position on the board). However, just because a successful crop is already priced doesn’t mean we won’t see a weather scare rally. It just tells me that if or when we see one, it will occur more quickly and more drastically. Be sure to have a plan in mind and offers in for when we start seeing the markets move!

December 13, 2022