Let the roller coaster of grain markets begin!

Jun 10, 2022

Zack Gardner

Grain Marketing & Origination Specialist

Crop conditions-

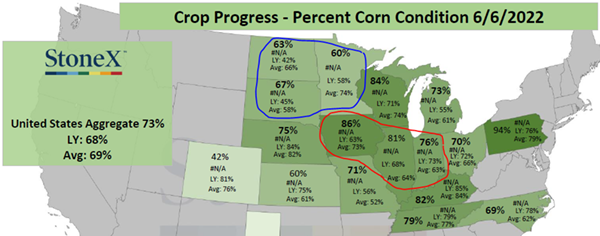

As of the second week of June, corn and soybean planting is basically caught up. Corn planting is 1 percent ahead of the average pace and soybean planting is 1 percent behind the average pace. We also had the very first corn conditions rating of the year this week. Corn conditions came in at 73 percent good-to-excellent, which is 5 percent ahead of last year at this time. Just driving the countryside, I struggle to find a field that I wouldn’t rate as good-to-excellent. In looking at the individual state ratings map, I was surprised at just how good the “I” states are.

Iowa corn is rated at 86 percent good-to-excellent, which is 23 percent better than last year. Illinois is rated 81 percent good/excellent, which is up 13 percent better than last year. And lastly, Indiana is rated 76 percent good/excellent, which is up 3 percent from last year. The rest of the fringe states aren’t looking too bad either. Nebraska, Wisconsin, Michigan, and Ohio are all 70 percent or better. The “Dakota” acres (circled in blue) are in the 60’s, but still well ahead of last year’s crop.

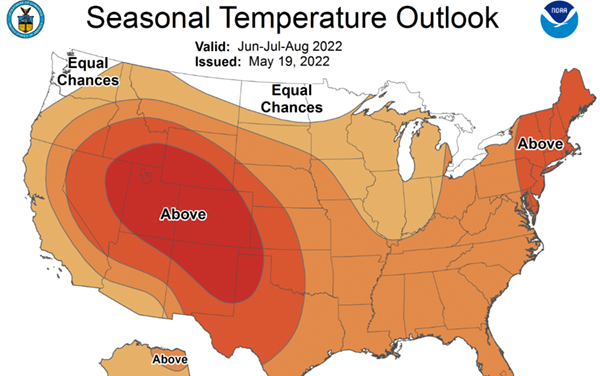

So where does the roller coaster begin? The weather forecast. Below is the June-August temperature outlook for the US.

Looking at the crop today, I would say that we need some heat. The 90’s in the forecast for next week are just what we need, but this seasonal temperature outlook map makes me nervous. The grain markets will have a hard time deciphering the fine line between “just what the doctor ordered” and excessive heat that will put corn into defensive mode. For now, I’ll take all the heat we can get, but the nice rains we’ve been getting need to continue for this temperature forecast to work.

The Acreage Battle-

The next area we’ll probably see the market roller coaster is with acres. We are currently 94 percent planted on corn, and 78 percent planted on soybeans. If we use the acreage intentions of 89.5 million acres of corn and 90.9 million acres of beans from the March Prospective Plantings reports, that leaves 5.3 million acres of corn and 20 million acres of soybeans left to plant as of June 6.

I questioned the original acreage numbers from March, but question them even more so now… how many acres will get switched from corn to beans with what propane and natural gas prices have been doing the past couple of weeks? Why plant corn this late if you know it will need more drying and if the cost of those inputs are still rising? How many acres will switch to spring wheat with the heat in the June/July/August temperature forecast? The Russia/Ukraine situation mostly effects corn and wheat, not soybeans, so could some of these unplanted acres switch from soybeans to spring wheat? Regardless, the current markets are paying guys to plant every acre possible, even if it’s late.

The USDA-

The first two roller coasters will probably be acreage and yield, but the third will probably be the Russia/Ukraine war and how the USDA interprets it. When Russia invaded Ukraine and blocked the Black Sea region back in February, they effectively cut off 14 percent of the worlds available corn supply. There is still a big question mark on Ukraine’s planted acres, but even if they do somehow produce a crop where are they going to go with it? They don’t have on-farm storage like we do in the US. A lot of their port facilities are destroyed, and even if they do get it to the port, ships are very unlikely to make it through the Black Sea to hit the export market. The biggest problem I see is that the USDA doesn’t have a way to distinguish whether or not corn is accessible to the world market. If Ukraine grows it, the USDA technically has to mark it down on paper, even if the world can’t get to it. From there, it’s a shot in the dark trying to guess what Ukraine will export for the year.