Playing Both Sides of the Fence

Jul 25, 2024

Zack Gardner

Grain Marketing & Origination Specialist

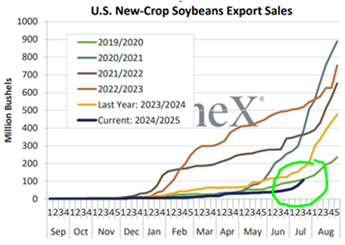

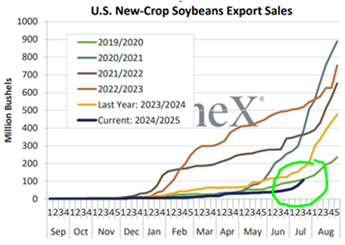

The entire grain market is wondering if we have found a bottom. Global grain carryouts for both corn and beans are still bloated and bearish, but now we have something to be excited about - exports!

So why did I title this article, “playing both sides of the fence?” Because the fundamentals are still bearish, which tells us we need to forward market, but there is also now some hope that prices might go higher. So how do we play both sides of the fence? With options strategies! And because the funds traders all standing on one side of the boat with record short positions, options are cheaper than normal.

Here’s how it works: a December at-the-money $4.20 put costs $0.20 and has a delta of 0.50, which means it is 50 percent correlated to the market. If the market were to continue rallying and gain $0.10, your put option that is 50 percent correlated to the market only loses $0.05, for an overall net gain of $0.05. You can then sell your put option back and purchase the next strike level higher. The best case scenario, is the market goes lower and your put option gains in value to offset the market drop. The worst case scenario, is that the market goes higher and you gain 50 percent of the upward market movement on top of your price floor.

If you have further questions about these strategies, would like to discuss them in greater detail, or see how they can be tailored to your operation, a member of the Key Cooperative Grain Team would be happy to visit with you. Bearish environments mean that we need to be forward selling. If you have reservations, there are strategies that will allow you to play both sides of the fence by locking in a floor and still keeping your upside potential open.

*Prices and numbers provided are examples and not guaranteed.

Grain Marketing & Origination Specialist

The entire grain market is wondering if we have found a bottom. Global grain carryouts for both corn and beans are still bloated and bearish, but now we have something to be excited about - exports!

So why did I title this article, “playing both sides of the fence?” Because the fundamentals are still bearish, which tells us we need to forward market, but there is also now some hope that prices might go higher. So how do we play both sides of the fence? With options strategies! And because the funds traders all standing on one side of the boat with record short positions, options are cheaper than normal.

Strategy #1 - Minimum Price Contracts

With this strategy we sell cash and buy a call option. Seeing that we sold cash, we have an established price floor in case the export hype wears off, but with the call option we can still retain our upside potential in case the rally continues. It’s a way to forward market our grain without fully pricing it.

For example, you could sell new crop cash corn today (July 25, 2024) in Sully, Iowa for $3.81. A March at-the-money $4.40 call option would cost $0.23. Worst case scenario, you lose the $0.23 you spent on the option and end up with a overall cash price of $3.58 ($3.81 sale - $.23 option cost). However, if the market keeps rallying, that $0.23 call option that we bought, keeps appreciating in value so you can add to the cash price you sold. Also, with the March call option, you would have between now and February 21st to finish pricing it. That timeframe would get you through the big January report in case we see a reduction in harvested acres from all the Northern Iowa and Southern Minnesota flooding.

For example, you could sell new crop cash corn today (July 25, 2024) in Sully, Iowa for $3.81. A March at-the-money $4.40 call option would cost $0.23. Worst case scenario, you lose the $0.23 you spent on the option and end up with a overall cash price of $3.58 ($3.81 sale - $.23 option cost). However, if the market keeps rallying, that $0.23 call option that we bought, keeps appreciating in value so you can add to the cash price you sold. Also, with the March call option, you would have between now and February 21st to finish pricing it. That timeframe would get you through the big January report in case we see a reduction in harvested acres from all the Northern Iowa and Southern Minnesota flooding.

Strategy #2 - Rolling Puts

The second strategy involves buying put options and rolling them if the market continues moving higher. This strategy only involves buying puts and doesn’t involve selling cash (which is helpful in case we have a hot, dry August so that we won’t be forced into delivering bushels we don’t have yet).Here’s how it works: a December at-the-money $4.20 put costs $0.20 and has a delta of 0.50, which means it is 50 percent correlated to the market. If the market were to continue rallying and gain $0.10, your put option that is 50 percent correlated to the market only loses $0.05, for an overall net gain of $0.05. You can then sell your put option back and purchase the next strike level higher. The best case scenario, is the market goes lower and your put option gains in value to offset the market drop. The worst case scenario, is that the market goes higher and you gain 50 percent of the upward market movement on top of your price floor.

If you have further questions about these strategies, would like to discuss them in greater detail, or see how they can be tailored to your operation, a member of the Key Cooperative Grain Team would be happy to visit with you. Bearish environments mean that we need to be forward selling. If you have reservations, there are strategies that will allow you to play both sides of the fence by locking in a floor and still keeping your upside potential open.

*Prices and numbers provided are examples and not guaranteed.