The Fight For Acres Is On!

Apr 04, 2022

Zack Gardner

Grain Marketing & Origination Specialist

All year, soybeans have been the commodity buying the acres, and rightfully so. Brazil’s first crop which is predominantly soybeans was in a pretty bad drought and China had been buying at a good pace. Then on February 24th, Russia invaded Ukraine and effectively took 14 percent of the world’s corn production off the market. The double whammy came with the Prospective Plantings report on March 31st, where the USDA switched 2.5 million acres from corn to soybeans. Based off the market information that the USDA had at the time, I can’t blame them for making this sort of a switch. $14.00 cash beans across the scale looks a lot more attractive than $5.50 corn with $1,500/ton ammonia. But who would really believe that Russia would in fact invade Ukraine and that we would go from needing soybeans so badly to needing corn!

Normally, the USDA is conservative with their estimates and always “behind the 8-ball”, making slow conservative adjustments throughout the season. A jump in acres this drastic is not normal for the USDA. How drastic of a change was their 2.5 million acreage switch? The USDA’s corn acre number was lower than every single analyst’s guess. It will also be the first year for the U.S. that soybeans will be the predominant crop! Perhaps they’re fudging their early season acreage estimates to entice us to plant more corn acres with a war going on? Maybe they want us to switch acres from beans to corn to drive up the soybean price on China?

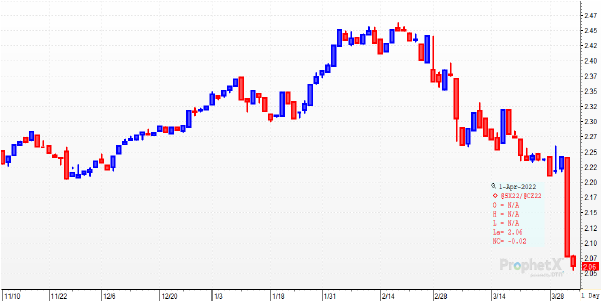

Either way, the fight for acres is on. Below is a chart on the corn:soybean ratio where a price ratio of 2.5 is the theoretical price point of indifference for which commodity to plant. Today’s corn:soybean price ratio of 2.05 strongly favors planting corn on any undecided acres.

Big picture, the Russia/Ukraine war is more of a wheat & corn play, since they don’t produce much soy. Unfortunately, I don’t see the war ending anytime soon and even if it did, repairing their grain export infrastructure wouldn’t happen overnight. The world is screaming for more corn acres to make up for it. From what some of the analysts have been saying, it would take roughly five million acres somewhere else in the world to offset Ukraine’s lack of production. It would certainly be do-able, but it’s a tall order. Looking back to years with similar grain prices (2012-2014), we planted about eight million more acres than we currently intend to, according to the USDA. We could easily find the acres here in the U.S. (hay/pasture/CRP/double cropping beans after wheat) but they wouldn’t be high production acres. Brazil could expand as well like they do every year, but with high input costs and/or lack of supply, I think those acres go to beans.

The market is screaming for corn acres right now and the efficient market should get us to a price point that gets us more corn acres. That doesn’t necessarily mean corn will buy those acres. It should, but it could also mean that wheat, soybeans or cotton lose those acres. There's lots of risk on the table but also lots of ways to protect it.