U.S. Crop Conditions and the Big Picture of Global Grain

Sep 01, 2022

Zack Gardner

Grain Marketing & Origination Specialist

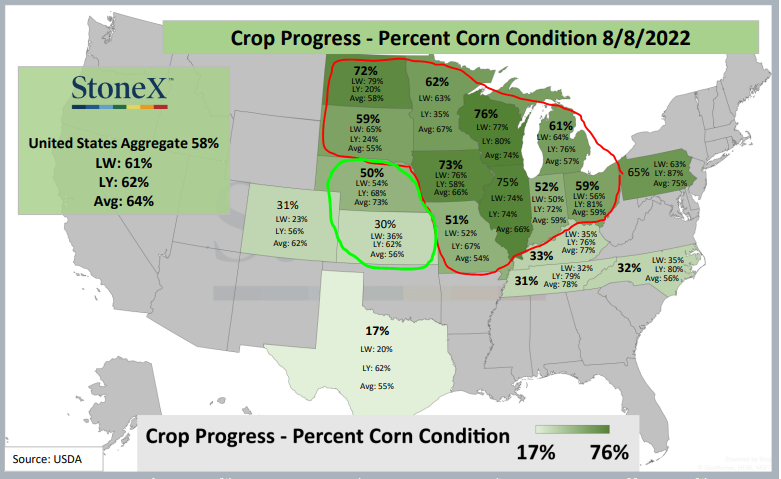

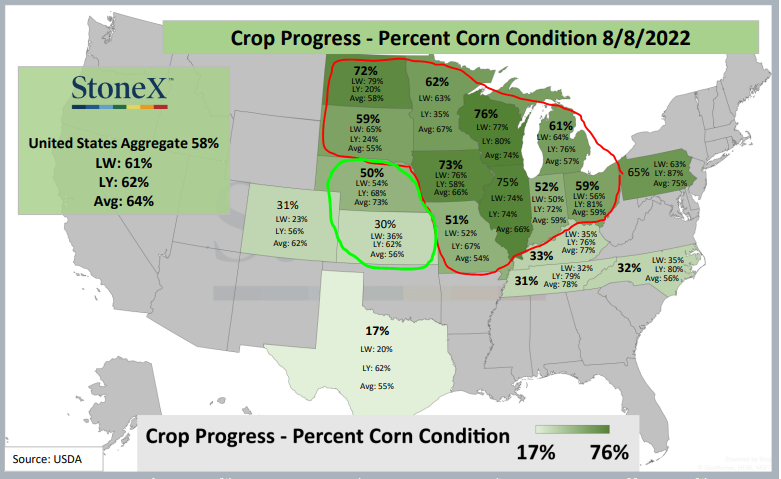

Our crop, especially south of I-80, is starting to struggle with the lack of rain. Yet as we inch closer to harvest, we have to keep in mind our grain markets revolve around global trade. We can’t base our marketing plans on what we see outside our kitchen windows. Our crop is definitely going to struggle locally. With how corn is currently faring, I think Iowa’s crop ratings (see map below) need to be reduced. However, looking at the big picture, a majority of the states in the U.S. are on par with last year’s crop ratings or well above them (see red circle on map). Circled in green are the two big states in the Midwest that are not at or above last year’s levels.

Getting into the nitty gritty of our crop, I could argue that Iowa’s crop estimates need to adjust a significant amount. In the areas that are tributary to Eddyville, do we back off our yield estimates by 15–20 percent? In the areas that are tributary to Cedar Rapids, do we raise yield estimates by 5 percent? There are pockets of both good and bad—even if we dropped the overall state yield estimate by a 10 percent average, we’d be only 1 percent behind last year’s crop ratings. I think these yield pockets may be more about the function of local basis at the various ethanol plants next year.

Another short-term factor for our markets will be the August 12 USDA report. Traditionally, we see an expected yield drop, but this year’s report will also have Minnesota and the Dakotas’ acreage resurvey on it. I think we will magically find more acres of corn, beans and wheat, as the market was incentivizing producers to plant every acre they could (even if they were flooded). The big question will be if an increase in acres will outweigh any reductions in yield for the U.S. balance sheet. With this report, we have to keep in mind that even though a lot of the U.S. is in drought conditions, the acres they may find in the Dakotas will likely be of good yield. South Dakota’s ratings are 35 percent better than last year, while North Dakota’s are 52 percent better than last year.

On a global scale, it seems like we continue to see extreme headlines on both sides of the aisle. So much so that it almost feels like the market doesn’t know how to react or which way to go. For example:

How does this all tie to marketing? The hot and dry weather that’s sending our crops backward is forcing a lot of us to be comfortable with the number of forward sales we have on the books. Before the market gets too crazy (in either direction), it may be wise to double check the sales you have on the books, check on your crop insurance levels and double check any offers you still have in the works that we might need to pull or adjust.

Grain Marketing & Origination Specialist

Our crop, especially south of I-80, is starting to struggle with the lack of rain. Yet as we inch closer to harvest, we have to keep in mind our grain markets revolve around global trade. We can’t base our marketing plans on what we see outside our kitchen windows. Our crop is definitely going to struggle locally. With how corn is currently faring, I think Iowa’s crop ratings (see map below) need to be reduced. However, looking at the big picture, a majority of the states in the U.S. are on par with last year’s crop ratings or well above them (see red circle on map). Circled in green are the two big states in the Midwest that are not at or above last year’s levels.

Another short-term factor for our markets will be the August 12 USDA report. Traditionally, we see an expected yield drop, but this year’s report will also have Minnesota and the Dakotas’ acreage resurvey on it. I think we will magically find more acres of corn, beans and wheat, as the market was incentivizing producers to plant every acre they could (even if they were flooded). The big question will be if an increase in acres will outweigh any reductions in yield for the U.S. balance sheet. With this report, we have to keep in mind that even though a lot of the U.S. is in drought conditions, the acres they may find in the Dakotas will likely be of good yield. South Dakota’s ratings are 35 percent better than last year, while North Dakota’s are 52 percent better than last year.

On a global scale, it seems like we continue to see extreme headlines on both sides of the aisle. So much so that it almost feels like the market doesn’t know how to react or which way to go. For example:

- Bullish global headlines: 50+ percent of Europe is under heat stress. Italy is buying corn from the United States. U.S. inflation didn’t increase in the month of July. Finally, 28 percent of U.S. corn is within an area experiencing drought.

- Bearish global headlines: China’s economy is slowing and showing signs of a recession. Twelve Ukrainian grain vessels have been exported so far, and China is ramping up military drills/aggression over Taiwan.

How does this all tie to marketing? The hot and dry weather that’s sending our crops backward is forcing a lot of us to be comfortable with the number of forward sales we have on the books. Before the market gets too crazy (in either direction), it may be wise to double check the sales you have on the books, check on your crop insurance levels and double check any offers you still have in the works that we might need to pull or adjust.