What Brazil Weather & Chinese Port Fees Mean for U.S. Old Crop Corn

Mar 28, 2025

Zack Gardner

Grain Marketing & Origination Specialist

By the time you read this, our markets will probably have moved significantly one way or the other thanks to either the March 31st Stocks and Acreage Report or the April 2nd Liberation Day tariff deadline. So, in this newsletter, we will try and talk about some other headlines that might be affecting our markets in the near future, while at the same time, realizing that our slate will probably be wiped clean with fresh data from the USDA or Truth Social by early in the week of March 31st.

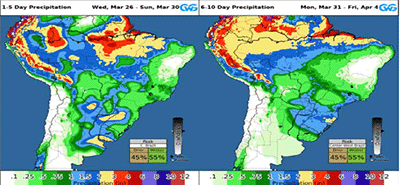

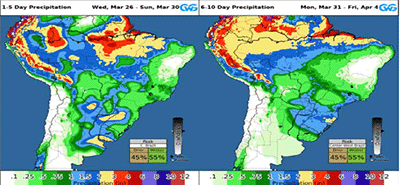

Probably the biggest factor, outside of the March 31st acreage report, is weather in Brazil. The U.S.’s old crop corn supply isn’t necessarily tight, but it’s on the line of potentially becoming tight in short order. Maybe the best way to describe it is “unsure and uncomfortable.” Brazil is wrapping up their safrinha corn planting and they are currently experiencing the driest start to their safrinha corn crop ever. I’m not worried yet, just like I wouldn’t be concerned about a drought in April/May here in the U.S. But if Brazil doesn’t start getting rains in April, the U.S. corn supply could go from uncomfortable to tight in a hurry as we would be the only game in town if China needs corn. Keep an eye on Brazil’s weather in April.

Click to view map.

The next biggest market-moving factor outside of the acreage report, is this proposal for port fees on Chinese-made ships looking to dock here in the U.S. In my opinion, this is way bigger than tariffs. This port fee debacle could completely shut off U.S. commodity exports. Depending on the ship size or the percent of Chinese ships in a particular shipping company’s fleet, it could add ~$0.35-1.50 per bushel in ocean freight to U.S. commodities. An efficient market would say that all current unshipped export sales would get cancelled and re-bought down in South America and then our basis would drop like a rock to factor in that ~$0.35-1.50 per bushel freight difference. Those cancelled export sales would then back up into our ethanol and feed yard markets, which would suppress basis here locally as well.

Fortunately, the public comment period for this port fee proposal last week brought so much overwhelming pushback that it was extended. There were a whole lot of union leaders, shipping companies, grain associations, export associations and ports speaking to Washington about this. Hopefully the feedback that they keep getting continues to be so overwhelming that they back off of this as it could be incredibly detrimental to U.S. grain markets. It’s definitely a potential black swan event worth keeping an eye on.

Otherwise, hopefully you had your seatbelt on for the March 31st Stocks and Acreage report and tariff talk! If the report did turn our markets bearish from more corn acres, that should provide opportunities for corn basis as well as new crop soybean marketing.

Grain Marketing & Origination Specialist

By the time you read this, our markets will probably have moved significantly one way or the other thanks to either the March 31st Stocks and Acreage Report or the April 2nd Liberation Day tariff deadline. So, in this newsletter, we will try and talk about some other headlines that might be affecting our markets in the near future, while at the same time, realizing that our slate will probably be wiped clean with fresh data from the USDA or Truth Social by early in the week of March 31st.

Probably the biggest factor, outside of the March 31st acreage report, is weather in Brazil. The U.S.’s old crop corn supply isn’t necessarily tight, but it’s on the line of potentially becoming tight in short order. Maybe the best way to describe it is “unsure and uncomfortable.” Brazil is wrapping up their safrinha corn planting and they are currently experiencing the driest start to their safrinha corn crop ever. I’m not worried yet, just like I wouldn’t be concerned about a drought in April/May here in the U.S. But if Brazil doesn’t start getting rains in April, the U.S. corn supply could go from uncomfortable to tight in a hurry as we would be the only game in town if China needs corn. Keep an eye on Brazil’s weather in April.

Click to view map.

The next biggest market-moving factor outside of the acreage report, is this proposal for port fees on Chinese-made ships looking to dock here in the U.S. In my opinion, this is way bigger than tariffs. This port fee debacle could completely shut off U.S. commodity exports. Depending on the ship size or the percent of Chinese ships in a particular shipping company’s fleet, it could add ~$0.35-1.50 per bushel in ocean freight to U.S. commodities. An efficient market would say that all current unshipped export sales would get cancelled and re-bought down in South America and then our basis would drop like a rock to factor in that ~$0.35-1.50 per bushel freight difference. Those cancelled export sales would then back up into our ethanol and feed yard markets, which would suppress basis here locally as well.

Fortunately, the public comment period for this port fee proposal last week brought so much overwhelming pushback that it was extended. There were a whole lot of union leaders, shipping companies, grain associations, export associations and ports speaking to Washington about this. Hopefully the feedback that they keep getting continues to be so overwhelming that they back off of this as it could be incredibly detrimental to U.S. grain markets. It’s definitely a potential black swan event worth keeping an eye on.

Otherwise, hopefully you had your seatbelt on for the March 31st Stocks and Acreage report and tariff talk! If the report did turn our markets bearish from more corn acres, that should provide opportunities for corn basis as well as new crop soybean marketing.