A Super-Mega-Bearish Bean Outlook

Sep 11, 2024

Zack Gardner

Grain Marketing & Origination Specialist

FOR STARTERS, let’s talk about corn. In the August 12 USDA report, they raised corn yields up to 183.1 bu/acre, which is bearish at first. But it was offset by a 700,000 acre drop in harvest acres plus a 100 million bushel increase to corn exports.

Beans, however, are a different story. We saw bean yields increase to 53.2 bu/acre and got a 1 million acre increase to planted acres, with no offsets like we saw for corn. These updated production numbers give us a stocks-to-use ratio of 12.8 percent!

To top things off, the USDA raised both acres and yield for the U.S. crop. Just one day post-report, and we show new crop cash beans with an 8 in front of them.

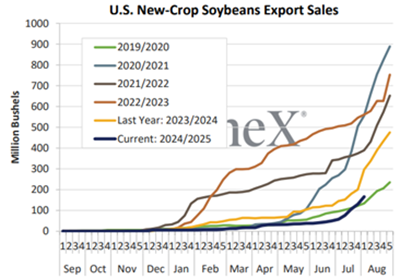

U.S. New-Crop Soybeans Export Sales

Forward market! Big crops mean big carries, which especially emphasizes forward marketing. We should be looking at any form of forward marketing that helps provide us with a price floor. For example:

There are many strategies to think about and carry to capture, which should help make these grain prices a little less painful.

Grain Marketing & Origination Specialist

FOR STARTERS, let’s talk about corn. In the August 12 USDA report, they raised corn yields up to 183.1 bu/acre, which is bearish at first. But it was offset by a 700,000 acre drop in harvest acres plus a 100 million bushel increase to corn exports.

Beans, however, are a different story. We saw bean yields increase to 53.2 bu/acre and got a 1 million acre increase to planted acres, with no offsets like we saw for corn. These updated production numbers give us a stocks-to-use ratio of 12.8 percent!

How the Outlook Goes From Bearish to Super-Bearish

Lately, the soybean market has been keeping an eye on our export sales. Our saving grace may have been China coming in and scooping up some late-season soybeans to bridge the gap until Brazil starts harvesting again in January. However, we haven’t seen that come to fruition. We’ve seen some sales, but not enough. As you can see on the chart below, China has bought just barely more than the 2019 crop year, where they lost approximately 50 percent of their hog herd due to African swine fever.To top things off, the USDA raised both acres and yield for the U.S. crop. Just one day post-report, and we show new crop cash beans with an 8 in front of them.

So Why Is the Soybean Outlook Super-Mega-Bearish?

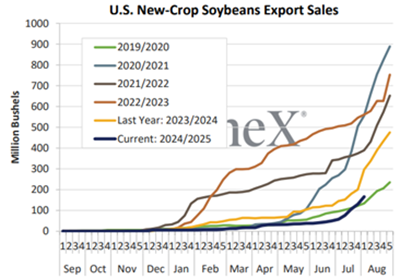

We have very low soybean export sales, and we just got an increase to soybean acres and an increase to yield. What happens if you throw in higher fall ammonia prices and lower farm revenue from declining grain prices? Do we see more soybean acres here in the U.S. next year as cash gets tight? I think the markets’ job right now is to disincentivize the Brazilian farmer from planting more soybeans next month, which would make this global soybean problem even worse!

U.S. New-Crop Soybeans Export Sales

What Can We Do About It?

Forward market! Big crops mean big carries, which especially emphasizes forward marketing. We should be looking at any form of forward marketing that helps provide us with a price floor. For example:- Sell cash. Leverage min./max. strategies (selling cash, buying a call and selling a call to cheapen up the strategy).

- Buy or roll put options and accumulators. Option volatility is surprisingly cheap right now, which tells us to be buyers of options instead of sellers. (There’s not much premium gained from selling options.) But we need to be careful, buying with the right strategy so we don’t lose money spent on options and make our already low cash prices even lower.

- Plant more corn. Does the profitability ratio of fall ammonia to December 2025 corn make more money than planting beans with November 2025 futures where they’re at?

There are many strategies to think about and carry to capture, which should help make these grain prices a little less painful.