Quick Soybean Check-In — and One More Reason to Be Bullish on Corn

Dec 01, 2025

Zack Gardner

Grain Marketing & Origination Specialist

China has been coming through, almost every other day, for soybean purchases. So far, it is estimated that China has bought approximately four MMT (about 146 million bushels), of the 12 MMT agreed upon between President Trump and Xi last month. China is close enough to being on pace with their buying, that reaching the 12 MMT total is plausible. That being said, two questions remain in my mind:

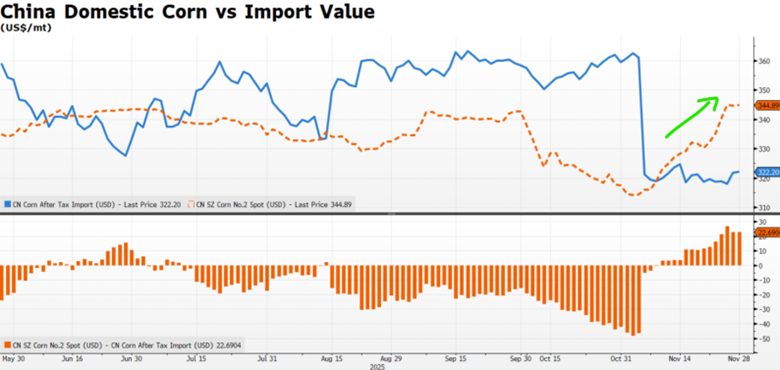

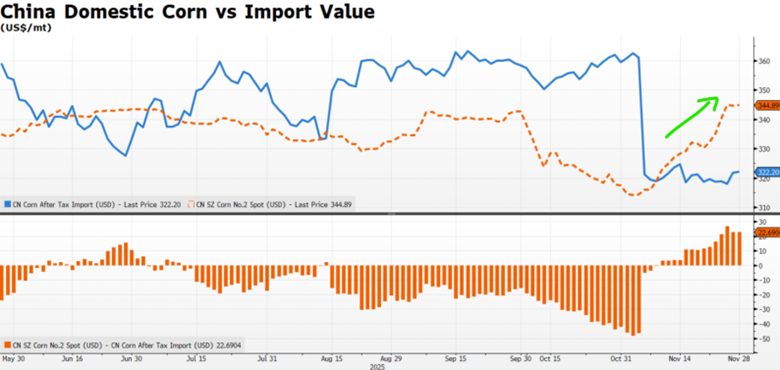

The USDA currently has very little corn exports penciled in for China and not only does the math work, but the math (price difference between China’s domestic corn prices versus import prices) is growing. On the chart below, the orange line is China’s domestic corn price which is rising, and the flat blue line is the price of imported corn.

With how little the USDA has penciled in for Chinese corn imports, there is huge potential. Especially when South America will be tied up with soybeans come February. We will be the only game in town if China needs corn for blending their damaged crop.

Grain Marketing & Origination Specialist

China has been coming through, almost every other day, for soybean purchases. So far, it is estimated that China has bought approximately four MMT (about 146 million bushels), of the 12 MMT agreed upon between President Trump and Xi last month. China is close enough to being on pace with their buying, that reaching the 12 MMT total is plausible. That being said, two questions remain in my mind:

- Of the 12 MMT agreed upon for total purchases in 2025, does that include the approximate 6.10 MMT of soybeans that China had already purchased and taken shipment on earlier this year? If so, China may only need to buy approximately 1.90 MMT (about 69 million bushels) more versus about 294 million more bushels if they bought 12 MMT of new soybeans.

- When will they take shipment on these purchases? Only three cargo ships have been put in route so far to load soybeans at U.S. ports. Tensions rising over Taiwan or Venezuela/Colombia, could risk cancellation of these soybean purchases. I think this is one of the reasons why the market hasn’t been getting more excited at these overnight flash sales of soybeans to China. If they haven’t been physically loaded, they are at risk of cancellation, especially as cheap Brazilian new crop soybeans come online in February.

The USDA currently has very little corn exports penciled in for China and not only does the math work, but the math (price difference between China’s domestic corn prices versus import prices) is growing. On the chart below, the orange line is China’s domestic corn price which is rising, and the flat blue line is the price of imported corn.

With how little the USDA has penciled in for Chinese corn imports, there is huge potential. Especially when South America will be tied up with soybeans come February. We will be the only game in town if China needs corn for blending their damaged crop.