October Market Outlook: Uncertainty for Soybeans, Optimism for Corn

Oct 01, 2025

Zack Gardner

Grain Marketing & Origination Specialist

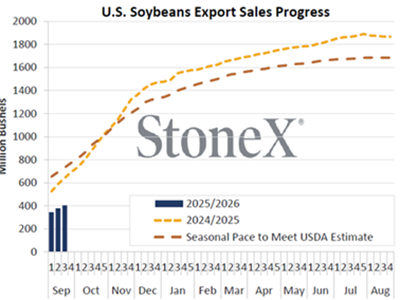

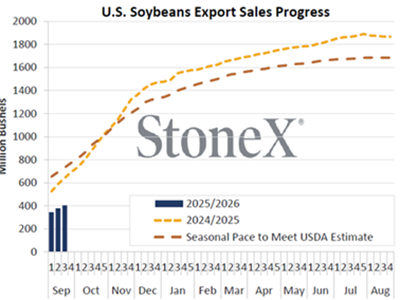

Starting with soybeans, we are chopping sideways in the middle of an approximate $1.00 trading range, waiting for confirmation on if China is buying or not. If China does start buying, we are easily $1.50 undervalued with our already tight carryout. But if China continues to stay away and doesn’t buy our soybeans, then we could be up to $1.50 overvalued. Until we get confirmation of which scenario we are in, we’ll probably keep chopping sideways on the chart.

Our typical soybean export timeframe is September through January until Brazilian new crop soybeans become available in February. So far this fall, China has been buying Brazilian soybeans at approximately a $1.40 premium to ours for the September/October shipment timeframe. They’ve also started releasing soybeans from their state-owned reserves to help calm their domestic market while trying to avoid U.S. grown soybeans. Then, this week Argentina announced a commodity tax suspension program. The program reduced Argentina’s soybean export tax from 26 percent to zero, essentially giving their farmers the equivalent of a $3.00/bushel. rally to incentivize them to sell and get foreign dollars flowing into their economy. This program filled the government’s revenue quota in three days and China ended up buying 2.5 MMT (approximately 91.8 million bushels) of soybeans for the November/December shipment timeframe.

So far this year, China has stayed absent from our soybean market and all signs point to them continuing to stay away. All it takes is one social media post from Trump or one rumor of China buying for the markets to get excited again, but otherwise our soybean market is a ticking clock until the USDA starts accounting for China’s absence on future USDA reports.

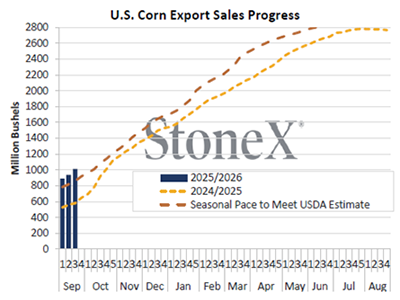

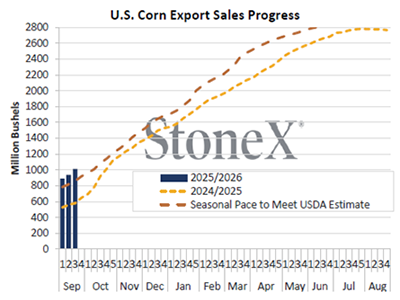

As for corn, the story is a little more optimistic. Early corn yields show that the USDA’s 186.7 bushels per acre yield estimate on the September report is still too high. I would expect for the U.S. corn yield figure to slowly get ratcheted lower on each report from here on out to the final report in January. Even if later yields on corn start coming in more “normal”, I don’t think we will have the record crop in Iowa and Illinois needed to justify the USDA’s above trendline yield.

In addition to our corn yields coming down, which is bullish, our corn exports are through the roof! We are already approximately 400 million bushes ahead of last year at this time for export sales.

Then the next question will be acres for next year. Will this year’s heavy corn acres rotate into heavy soybeans for next year, given a record high nitrogen-to-corn price ratio?

Grain Marketing & Origination Specialist

Starting with soybeans, we are chopping sideways in the middle of an approximate $1.00 trading range, waiting for confirmation on if China is buying or not. If China does start buying, we are easily $1.50 undervalued with our already tight carryout. But if China continues to stay away and doesn’t buy our soybeans, then we could be up to $1.50 overvalued. Until we get confirmation of which scenario we are in, we’ll probably keep chopping sideways on the chart.

Our typical soybean export timeframe is September through January until Brazilian new crop soybeans become available in February. So far this fall, China has been buying Brazilian soybeans at approximately a $1.40 premium to ours for the September/October shipment timeframe. They’ve also started releasing soybeans from their state-owned reserves to help calm their domestic market while trying to avoid U.S. grown soybeans. Then, this week Argentina announced a commodity tax suspension program. The program reduced Argentina’s soybean export tax from 26 percent to zero, essentially giving their farmers the equivalent of a $3.00/bushel. rally to incentivize them to sell and get foreign dollars flowing into their economy. This program filled the government’s revenue quota in three days and China ended up buying 2.5 MMT (approximately 91.8 million bushels) of soybeans for the November/December shipment timeframe.

So far this year, China has stayed absent from our soybean market and all signs point to them continuing to stay away. All it takes is one social media post from Trump or one rumor of China buying for the markets to get excited again, but otherwise our soybean market is a ticking clock until the USDA starts accounting for China’s absence on future USDA reports.

As for corn, the story is a little more optimistic. Early corn yields show that the USDA’s 186.7 bushels per acre yield estimate on the September report is still too high. I would expect for the U.S. corn yield figure to slowly get ratcheted lower on each report from here on out to the final report in January. Even if later yields on corn start coming in more “normal”, I don’t think we will have the record crop in Iowa and Illinois needed to justify the USDA’s above trendline yield.

In addition to our corn yields coming down, which is bullish, our corn exports are through the roof! We are already approximately 400 million bushes ahead of last year at this time for export sales.

Then the next question will be acres for next year. Will this year’s heavy corn acres rotate into heavy soybeans for next year, given a record high nitrogen-to-corn price ratio?